Managing Minijobber

In this article you can find all information about the Minijob contract type, how to set it up, and how to do the reporting

It is now possible to use the minijob contract type in Shiftbase. For an employee to be registered as a Minijob. Depending on the hourly wage, we calculate the limit of working permitted hours. Also, you can administer the amount of hours to be paid out to be forwarded to your payroll administration.

Content:

How to set up a Minijob contract

How to set up a Minijob contract

To use Minijob functionality, make sure it is activated in the Settings > General > Features

You can now find the minijob contract type in the Settings > Employee > Contract types:

Existing Premium accounts can create a new contract type for the Minijob. If a new contract type should use the Minijob function, enable the checkbox Minijob.

⚠️Warning: This can not be changed after the contract type is created.

For the absence policy, the flex hour one will be preselected, but you can customize it or create a new absence policy for the Minijob (only available in the Premium plan).

Once the Minijob contract is created, it can be assigned to the desired employees in their employee profile under the contracts tab.

Salary and monthly limit

The minijob contract can be given to an employee in the Employee menu under Contracts. It is vital to set up the hourly wage for minijob to work. Depending on the hourly wage, the monthly limit for the Minijob will be calculated automatically.

💡Tip: If a certain amount of hours has been agreed upon with the Minijob employee, it can be calculated in the following way into the salary:

Max salary for a Minijob employee per month (€556 for 2025) divided by the number of hours they should be worked (f.e. 30 hours) it would be €18.53/ hour.

If you are not certain about the hourly wage, please contact your bookkeeper.

Absence

In the employee’s contract, the absence balance can be defined. Depending on the absence policy assigned to the Minijob contract type, both the accrual of time-off balance and the hourly value of an absence day can be configured. Below are two examples illustrating a dynamic and a fixed absence accrual setup.

Dynamic absence accrual:

This configuration is predefined in the absence policy Flex hours. The number of absence days must be set in the contract based on a 5-day work week. By default, the accrual is calculated over worked days. The system can only calculate the absence value for past periods based on actual worked days, but cannot predict future balances. To enable forecasting, contract hours can be used. Set the average number of working days in the contract, so the system can use this as the basis for calculation. Don't forget to save the changes at the end of the contract.

Example:

A Minijobber works on average 2 days per week and is entitled to 4 weeks of holiday per year, resulting in 8 holiday days annually. To calculate this correctly, the time-off balance in the contract should be set to 20 days per year. The contract hours for 2 days can include an average number of hours to generate an accurate forecast.

⚠️ Attention: In case an employee works more or less, the accrual will change automatically according to the worked hours. Only the forecast is based on the contract hours.

How many hours an absence day is worth can be defined in the absence policy.

Fixed absence accrual:

This configuration is predefined in the absence policy Fixed hours. The number of absence days must be set in the contract based on a 5-day work week. By default, the accrual is calculated over the contract hours. Set the average number of working days in the contract, so the system can use this as the basis for calculation. Don't forget to save the changes at the end of the contract.

Example:

A Minijobber works on average 2 days per week and is entitled to 4 weeks of holiday per year, resulting in 8 holiday days annually. To calculate this correctly, the time-off balance in the contract should be set to 20 days per year. The contract hours for 2 days can include an average number of hours to generate an accurate amount of days.

💡 Tip: How many hours an absence day is worth can be defined in the absence policy.

Starting balance

When your Minijob employee already has hours to carry over (for example, you start with Shiftbase in the middle of the month and the employee has already worked), you can add those hours with Bulk Action > Correct balances.

To perform this action, you need to go to the Employee Tab. You can select the users in the top left corner, or simply use the filter Contract types on the top right. You click on Bulk-Action > Correct balances.-4.png?width=670&height=256&name=image%20(3)-4.png)

In the bulk actions window, you select Minijob Balance on top, enter the date and the amount of hours per user individually.

The starting correction is now visible in the Minijob tab in the user's profile.-Nov-12-2025-08-57-02-0524-AM.png?width=670&height=447&name=image%20(5)-Nov-12-2025-08-57-02-0524-AM.png)

⚠️Caution: This correction is meant only for the carry-over (starting) balance of the employee and is not meant for the Payout.

Daily use

An employee with a Minijob can be scheduled and clock their times like any other employee.

In the schedule, when the Show totals filter is activated, you can view additional details for Minijob employees, identified by the piggy bank icon. This view shows:

- Total hours: The total number of hours scheduled and clocked for the month

- Max. hours: The maximum number of hours allowed per month

- Percentage: The percentage of total hours compared to the limit (visible when hovering over the icon)

⚠️Attention: In the total hours for the past the approved hours from the timesheet are taken and for the future the scheduled ones according to the schedule.

In the employee tab, you can find a new menu item for your Minijobbers called Minijob.

![]()

Here you can see all past approved worked hours per month and if those have been paid out or not. If hours have not been paid out, or an employee has worked more in a month than they got paid out, the amount will show in the balance for the next month.

When hovering with the cursor over the circle on the left side, you can see the percentage of the monthly worked hours, so how many percent of the monthly limit an employee has already worked. If the amount exceeds the monthly limit, the circle turns orange and shows a warning.

On the right side, you can see in the same way the payout date for the month.

Payout

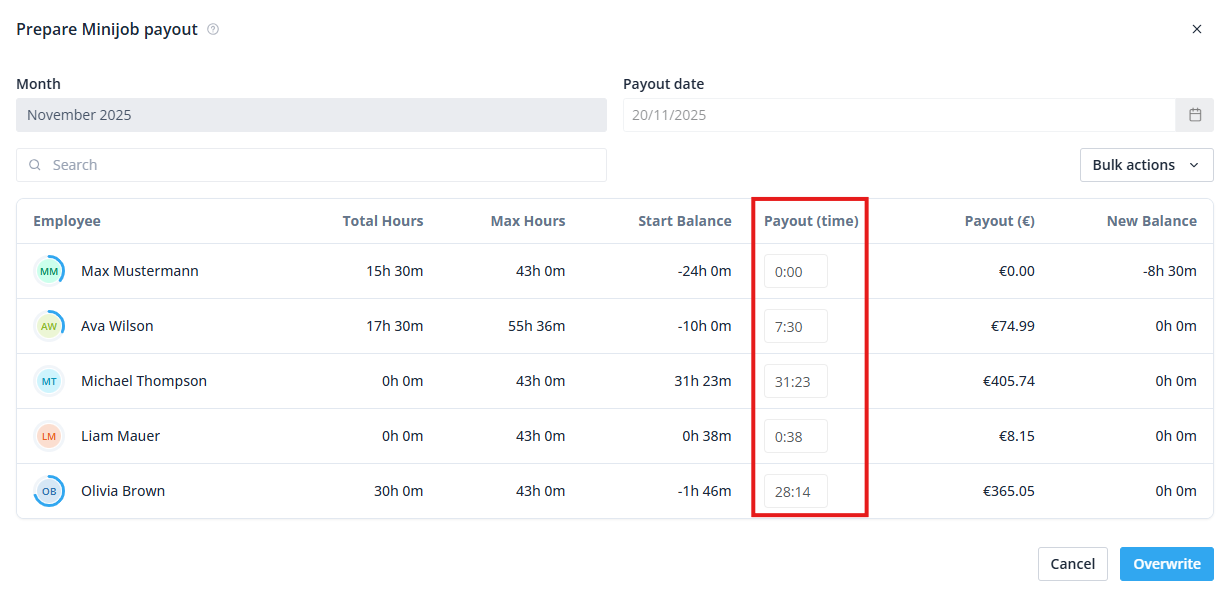

The payouts for the Minijob employees can be prepared in the timesheet > actions > prepare Minijob payout. This function is a preparation, that can be adjusted later again. There will not be a payout made, this is just a preparation in order to export your payroll hours and mark the hours as paid in Shiftbase.

In the payout column, you can select per employee how many hours each employee gets paid for the selected month. With the search field you can look for specific employees.

⚠️ Attention: The payout date can not be changed afterwards any more.

With the bulk actions, you can select if you want to pay out the maximum allowed hours per month according to the contract or all of the worked hours, that the employee has currently worked.

These numbers can be adjusted afterwards as well if needed. With clicking the finish button, the hours are being sent to the payout, and they will be marked as paid for the employee.

⚠️ Attention: All employees will be updated at the same time. You can not select individual employees. If you need to make an adjustment, you can change one number for the wished employee, but all other employees are being updated as well.

Reports

In the reports, you have 2 options to get data about the Minijob employees: the payroll report and the period overview.

In the payroll report, there are columns for Minijob payout, through which you can see what hours have been paid for which time period.

The period overview offers the worked hours and the salary, inclusive all surcharges and absences.

⚠️ Attention: The payout date has to be in the selected time period for the report, for it to have the paid hours in there.

-1.png?width=180&height=60&name=shiftbase-text-logo-transparent-dark%20(3)-1.png)